Are you or a client looking to secure a loan in the neare future? Sometimes real estate agents have three to six months working with a client before applying for a loan. This can be long enough to increase a credit score if the agent and the client understand how to do so.

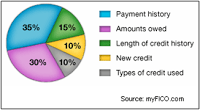

We’ve compiled 5 Ways to Improve Your Credit Score based on the weighted areas that FICO (Fair Isaac Corporation) uses in most situations. Here is a pie chart that shows the breakdown:

1. Pay bills on time (Approximately 35%)

Payment history typically is a significant factor. It is likely that your client’s score will be affected negatively if they have paid bills late, had an account referred to collections, or declared bankruptcy, if that history is reflected on their credit report.

Most scoring models evaluate how late the payment is, how recently the late payment occurred, and how many late payments there are. A 90-day late payment last month will reduce a score more than a 120-day late payment three years ago. Late payments involving smaller amounts are not as significant as ones involving larger amounts.

The longer a person pays their bills on time the better their score becomes.

Paying off an account where there was a late payment will not normally remove it from a person’s credit report and it will still be still be evaluated to arrive at a credit score.

2. Limit outstanding debt (Approximately 30%)

Most scoring models evaluate the amount of debt your clients have compared to their credit limits. If the amount they owe is close to their credit limit, it is likely to have a negative effect on their score. Owing a lot of money on many accounts can be an indication that a person is overextended.

The most effective way to improve your client’s score in this category is to get them to pay down their revolving credit. A person with a high amount of outstanding debt can increase their score by 30 – 50 points by paying off 90-100% of that debt.

The credit scoring models have certain threshold levels to identify higher risks.

If a person has used 70% of their available credit they are perceived to be in the highest level of risk.

The next threshold is 50%. Reducing credit card balances to below 30% of the credit limit will save your client a bundle on interest charges.

Similarly, a person’s score will be higher if the balance is evenly spread out among all of a person’s credit cards instead of having the same total amount on just one card.

3. Preserve length of credit history (Approximately 15%)

Generally credit models consider the length of a person’s credit track record. An insufficient credit history may have a negative effect on their score.

Even someone who has not been using credit for very long can get a high credit score depending on their other factors.

Most credit scoring models consider both the age of a person’s oldest account and the average age of all of their accounts.

New accounts lower a person’s average account age and can have a greater effect on their score. Rapid account buildup is also considered risky behavior in most credit scoring models.

Instruct your clients to use every credit card they have at least once every six months to avoid having the card go inactive. Inactive accounts can be ignored by credit scoring software and the client may not receive the benefit of a low balance and a long and positive payment history.

It is a good idea to keep and occasionally use older credit cards to maintain a higher score, even if the credit card has an outrageous interest rate.

One thing that all individuals who have high credit scores possess is a credit account that is at least twenty years old.

4. Avoid recent credit applications (Approximately 10%)

Many scoring models consider whether your clients have applied for credit recently by looking at inquiries on their credit report. If a person has applied for too many new accounts, it may negatively affect their score. Not all inquiries are counted.

Inquiries by creditors who are monitoring an account or looking at credit reports to make a person a “pre-approved” credit offers are not counted.

When a person accepts a credit offer it’s treated as a “hard inquiry” that’s factored into the score, even though they may never receive the card or use the account.

Tell your clients not to apply for a card they’re not likely to get.

Also, a person can request and check their own credit report and credit score and it will not negatively affect most credit scoring models if the report was ordered directly from a credit-reporting agency.

Some scoring models differentiate between a search for a single home or car loan and a search for many new credit lines.

Inquiries can have a larger impact on a credit score if a person has few accounts or a shorter credit history. Inquiries remain on a person’s credit report for two years. Some credit scoring models only count inquires for the past twelve months. If a person had a number of inquiries and only a short period of time remains before they drop off their credit report it may be beneficial to wait to apply for credit.

5. Manage the number and types of credit accounts (Approximately 10%)

It is generally good to have established credit accounts. Someone who has no credit cards could be considered a higher risk than someone who has credit cards and managed them wisely.

The ideal number of credit cards to maximize a credit score is three to five. Having more will not necessarily significantly affect a person’s score.

A good general rule is to never close a credit card account unless it was created in the past two years and the person has over six credit cards.

Generally a mix of credit cards, retail accounts, installment loans and mortgage loans results in a better score.

A person shouldn’t open accounts or take out loans just to have a better credit mix.

________________________________________________

Learn more about how to repair credit and how to protect you and your clients from identity theft by joining Larson Educational Services for Credit, Fraud and Identity Theft taught by Lynne Lovern, plus get 4 CE Credits if you hold a Florida real estate license.

UPCOMING COURSE DATES & TIMES

Date: Friday, August 13, 2010

Time: 1:00pm – 5:00pm

Location:

Royal Palm Square

1400 Colonial Blvd, Suite 44

Fort Myers, FL 33907

Tuition: $28

Date: Friday, September 10, 2010

Time: 1:00pm – 5:00pm

Location:

Horseshoe Park of Commerce

3073 Horseshoe Dr S, Suite 114

Naples, FL 34104

Tuition: $28

Register by calling (239) 344-7510

or

CLICK HERE to register online

Google